Buying your first home in Canberra is one of the most exciting and intimidating times of your life and it can be confusing to know where to start. There are a lot of processes and steps to take before, during and after you make an offer on your first home.

Below is a brief overview of the steps you should put in place to get you on your way to buying your first house.

Save your deposit

In preparation of buying your first house you will need to start saving for a deposit. The amount of your deposit should be in excess of 5% which is possibly the minimum required. In the past banks were happy to give 100% home loans or in some instances up to 103% to cover the purchase price of the property and all the associated costs such as stamp duty and legal fees.

Since the GFC in 2008 banks have been more conservative and would definately like to see a continued savings pattern. Your ability to save a deposit for your home loan shows the bank that you are good with money and should therefore put you in a good position to repay the loan when you buy your first house.

Getting a loan

Once you’ve saved your deposit it’s then time to decide where you will get your mortgage from. The two main options are going directly to the Bank or alternatively talking with a Broker. There are advantages for either option but it’s best to shop around and make sure that you get the best deal for you.

Going directly to the bank you’ve had your savings account with since day one is an easy option however it may not always get you the best result.

A Mortgage Broker is an independent party that will talk to all of the banks on your behalf and work out the best option for your circumstances. In most cases this will mean getting a lower interest rate which will in turn save you money through your repayments for the life of the loan. In some instances a Broker may get you the same interest rate but better options such as enabling you to get a loan with a lower deposit or something similar.

When it comes to repaying your loan, the the interest rate you are charged will make a huge difference.

For example, having an interest rate of 5% on a loan of $300,000 would have monthly repayments of $1,610 and over 30 years you would pay $279,767 in interest. However, if the interest rate were 4.75% on the same amount of $300,000, the monthly repayments would be $1,565 and your interest over 30 years would be $263,379. That’s a saving of $16,388 through the lifetime of your loan.

Stamp Duty

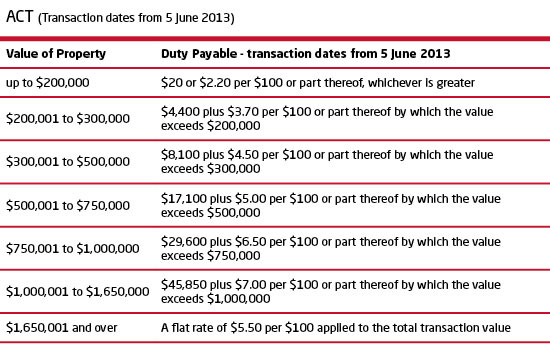

One of the larger costs in purchasing any property in Canberra is Tax. This purchasing tax is otherwise known as Stamp Duty. The amount you pay is dependant upon the cost price of the property. Currently if you were to purchase a home at $400,000 the tax would be $12,600. If you were to buy a brand new home this amount may be lower depending on the purchase price of the property. Below is a table which outlines the current stamp duty pricing structure however this is likely to change.

First home buyers grant

It seems like the government is changing their mind every five minutes about the grant for first home buyers. At the time of writing this article the first home owners grant in Canberra is $12,500 and applies only to brand new homes or a substantially renovated home that has not been lived in since its renovations.

Incidental charges

Unfortunately, saving for your deposit is not the only thing you need to think about when preparing to buy your first home. There are a lot of other charges that you need to keep in mind when going through the purchasing transaction. Here are the main ones:

- Solicitor or Conveyancer – your solicitor handles the legal side of the sale and ensures that your interests are looked after

- Building Inspection Report – the seller of every property in Canberra has to have a building report prepared before the home goes on the market. The costs of this report is passed onto the buyer at completion of the purchase

- Bank fees – most banks have a loan application fee and in some instances there are also ongoing monthly fees

- Insurance – now that you are buying your first home you’re going to need to make sure it’s properly insured by getting home and contents insurance

As you can see, there is a lot to think about when buying your first house in Canberra. It’s a really big decision and can seem daunting but once you get on the property ladder you will be glad that you are paying your own mortgage rather than someone else’s.