Chances are, you bought your family home in Canberra decades ago and the process of buying and selling has likely changed a lot since you moved all those years ago. Making the decision to go from your large family home to a smaller dwelling is exciting, yet it can be difficult to know where to start as there may appear to be so many things to think of.

To assist you with preparations for this move I will outline below some key steps to get you started.

A few points I’ll be covering are:

-

The pros and cons of staying in your family home

-

When is the right time for you to downsize

-

What options do you have

-

What is the best option for your circumstances

-

Minimising your belongings

-

How long will it take

-

The government assistance for over 60’s

So, without further ado let’s get started with the pros and cons of staying in your current home.

Pros and cons of staying in your family home

As with every situation you face in life, there are pros and cons for staying in your family home versus downsizing to a smaller property. The pros for staying in your home include familiarity of the property and the surrounding area. The house will be full of lovely memories of the kids growing up and you’ll always have plenty of room for guests.

Unfortunately, having the larger house also means there is more to clean, inside and out, and there may also be a lot of garden maintenance to do. The layout of your home may also be suited to a large family and now the kids are gone and you’re not working you may feel the pinch of the gas and electricity bills, especially heating a large home during our extremely cold Canberra winters. There may also be stairs to negotiate on a daily basis which you would prefer to live without.

When is the right time?

How will you know when it’s the right time to downsize? You might view downsizing as a confession to yourself that you are getting older and these negative views about your own mortality may hinder your willingness to take the first step. Keeping this in mind, there are many positive aspects to downsizing that you need to focus on as they can far outweigh your negative concerns.

Over the last decade I’ve had the great privilege of helping many people in the same situation you are in now. They were feeling the burden of maintaining a large house but weren’t sure how to make the transition to something more manageable. In each and every one of these cases, after they made the move they were always glad that they did. And the most common thing they would say is “We wish we had done it sooner”. They removed many of the chores of the large home and were able to live a happier life in a small community of people their own age who very quickly became good friends.

Knowing when it is the right time is personal and unique to each of us however human nature dictates that we can often put off such a decision until it is too late, leaving our family to make the decision for us.

If your children have grown up and are living their own independent lives; now may be the right time for you to downsize. You most likely feel at the prime of your life, with the freedom of retirement, no or low mortgage and time to pursue your interests and hobbies.

What are your options to downsize?

- Courtyard home – A courtyard home is simply a small house set on a small block of land. Typically land of around 400 square metres. This would enable you to downsize from your current home to another house which is much more easily maintained. You won’t need to worry about cleaning a large house and the garden should be very low maintenance as well.

- Townhouse/Apartment – A Townhouse or Apartment are also excellent choices for a low maintenance lifestyle. In each of these cases you would also have very little to maintain. With an apartment there would be no garden to mow and even in a townhouse it’s very common that the body corporate would look after most of the gardens in the common areas so you would possibly only need to worry about maintaining a small yard or entertaining area.

- Retirement village/Nursing home – This may be the best option in most cases. Retirement villages are specifically set up to accommodate mature age people and as such, all the occupants in a village are of a similar demographic. This means that you get to spend your time with others who live life at the same pace as yourself. Many of the villages have activities which you can enjoy such as lawn bowls or card games. It is also very common to have weekly group outings which you are able to join if you wish. This may include going down the coast for a day or simply heading out for lunch to one of Canberra’s great restaurants.

The above are the most common downsizing options, however I have seen many instances of children building a granny flat in their backyard for the parents to move into, or simply converting part of the house to accommodate the parents at one end and the rest of the family at the other.

Which option is right for you?

Moving into a courtyard home or small house may seem like the easiest and most appealing option, there are no ongoing body corporate fees or maintenance charges such as with a retirement village or a townhouse. You would however need to consider your age and current fitness levels if you wanted to take this option. While you may decide to move into a smaller home as preparation for a retirement home, you may find that you are only able to stay in the property a limited number of years before you need to move again. In which case you would need to pay the associated costs of moving twice.

While a Townhouse or Apartment does not have the same benefit of owning your own block of land it does offer some other things which a free standing house does not. There can be a feeling of community in a townhouse complex if most of the occupants are of a similar age group to yourself. You may feel more at ease when going on holiday as your neighbours are more likely to keep an eye on your home while you are away.

The third option we have is the Retirement Village. With this option you can rest easy knowing that your neighbours will all be of a similar age to yourself and therefore you won’t need to worry about any wild parties or disturbances from the neighbours. There are generally nurses on call in case you have a fall or need some medical attention quickly. Many retirement villages offer events and ‘resort style’ facilities while living in the comfort of your own home.

One last thing to bear in mind with the above accommodation options are the ongoing costs associated with Townhouses, Apartments, Retirement Villages and Nursing Homes.

If you live in a Townhouse or Apartment there would be a Body Corporate cost which is paid on a quarterly basis. These are costs that you wouldn’t have encountered while living in a free standing home. Body Corporate fees are in place to pay all of the regular bills associated with the complex such as maintaining the communal gardens, building insurance for each property and any upgrades to the complex through time.

If you downsize to a retirement village or nursing home you would also encounter a quarterly charge. These can be higher than the townhouse complex as you are paying for the same things as a normal townhouse complex however you are also paying for some extra luxuries such as a ‘Club House’ or reception area. Many retirement villages have a group dining area as well. This way you have the option to eat with friends and neighbours instead of staying at home.

Ultimately, it’s up to you which option to take but hopefully the above points will give you some insights to help guide you with your decision to downsize to the new home which is most suitable for your future needs.

Downsizing your belongings

One of the most difficult parts of downsizing is reducing your belongings and parting with those that you no longer need or have room for. There is no easy way to do this; you just have to keep the mindset that you cannot take everything with you when you move. This can take several months of sorting and resorting; and the more you persist, the easier it will become to part with your possessions.

- Write a list: Include the items that you cannot bare to part with. This will give you something to focus on when you are parting with other items that do not make the list.

- Work on small areas at a time: Sorting through smaller areas at a time will help break up the packing process and will be less daunting. Break them up with other more enjoyable activities. For example set a goal of sorting through the bathroom cupboard and then meet a friend for coffee as a reward. This will achieve more than standing in your garage for hours not knowing where to start. Work through your house room by room until the whole house is done. you may need to do this more than once, each time reducing your belongings until you are left with the bare minimum.

- Plan out your new home: downsizing means living smaller. This might mean that your furniture will not fit in your new home. Measure out your hew home and determine what will fit and what you will need. Sell or donate any furniture items that you won’t need to clear up space.

How long does it take?

Your personal situation is unique, but chances are you will need to sell your current home in order to finance your new home. As a downsizer you don’t want to be burdened with a large mortgage and if you sell before you buy you will have the cash at hand to purchase your new home with minimal stress. In most instances you will be able to arrange a delayed settlement on the sale of your home which will give you extra time to move straight into your new home without any overlap. This way you don’t run the risk of an expensive bridging loan.

Over 60’s home bonus

The government often offers initiatives for people purchasing a property. These are constantly changing so it is best to do your research and determine if any benefits apply to you.

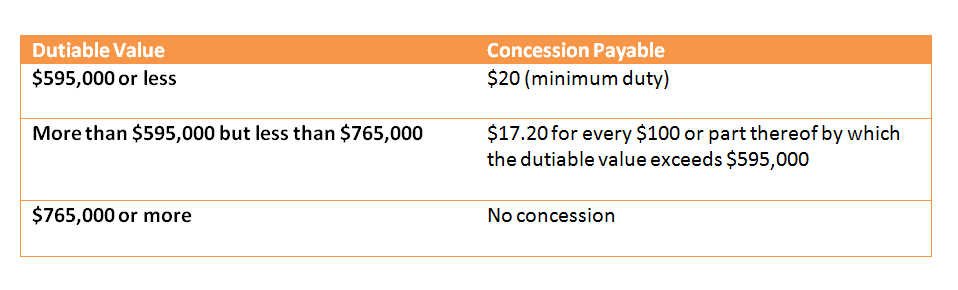

If you are over 60 and are intending to downsize you may be eligible for the Over 60’s Home Bonus Scheme. This scheme is valid for the 2015 and 2016 financial years for those who are intending on selling the home they are currently living in and downsizing. Those who are eligible will pay stamp duty at a concessional rate. If the property you are purchasing is less than $595,000 then you will only pay a $20 administration charge instead of the full stamp duty that would normally be paid.

Below is a table which gives an overview of the different concessional brackets:

I hope this helps give a good understanding of what is involved when downsizing. I’ve also written an article on some things to remember when moving house in Canberra which you should read to get a good idea of some things to do in preparation of the move.

Please feel free to comment below, send me an email or call me if you have any questions about your current situation and your plans to downsize in the coming months or years. I would welcome the opportunity to be of service.

Very informative. Helpful.

Thanks Rodney,

Glad you found this article useful.

Please feel free to let me know if you have any real estate questions and I’d be happy to help you out.

Mark